The AM Best insurance ratings system gives consumers a comprehensive overview of how individual insurance companies pay claims and handle debts. Furthermore, it offers commentary, analysis and research about the companies it inspects.

AM Compares rates from over 16,000 insurance companies around the globe to help consumers choose the most reliable providers who possess strong financial health and are capable of paying out claims when needed.

AM Best Insurance Ratings

Insurance ratings are an integral component of any consumer’s decision-making process. They enable buyers to assess an insurer’s financial stability, as well as whether it will pay out claims promptly and completely. Rating agencies such as AM Best or Fitch provide consumers with reliable information about which companies are most likely to fulfill their obligations.

AM Best rates a wide variety of insurance companies, such as those providing homeowners, auto, health, renters and more. Their ratings are based on an organization’s balance sheet strength, operating performance, business profile and enterprise risk management capabilities.

AM Best stands out among other credit agencies by specializing in assessing the financial strength and credit quality of debt obligations issued by insurance companies. In addition to rating companies, AM Best also covers insurance sector news and data analytics, making it a valuable resource for all researchers within this sector.

AM Best’s website provides customers with up to five years of ratings, enabling them to observe how each carrier performs over time and what its future may hold. Furthermore, these ratings updated regularly in order to account for major shifts in a company’s finances or operations.

For instance, if an insurer is involved in a major data breach that has long-term effects on both their business and customers, AM Best will adjust their scores to reflect this development. Likewise, if one insurance company acquired by another one, AM Best will adjust the score to accurately reflect the new company’s operations.

In general, AM Best ratings are a reliable indication of an insurer’s financial strength and capacity to pay out claims promptly and fully. However, other aspects such as coverage, costs, and service areas should also taken into account when assessing an insurer’s suitability for your needs.

Though AM Best ratings can be useful for consumers comparing insurers, it’s essential to remember that they only serve to indicate an insurer’s financial strength. Therefore, research each company’s features and rates as well as its service area and coverage options before making your decision.

Financial Strength Ratings

Financial strength ratings are an invaluable resource for policyholders when selecting an insurance company. They help you focus your search on strong companies and avoid weak ones, giving you peace of mind in making a purchase.

AM Best has been an independent insurance rating agency since 1899, providing in-depth financial analysis reports to assess an insurer’s creditworthiness and then assigning each company a letter grade.

Insurers with high AM Best ratings typically possess strong balance sheets and favorable business profiles, making them more likely to pay out claims in the event of a disaster. However, factors like company history and geographic concentration can negatively affect its score.

AM Best ratings widely trusted as one of the oldest and largest rating agencies worldwide, boasting an impressive record for accuracy. Their services utilized by consumers as well as investors alike for their assurance in financial transactions.

Financial strength ratings exist in various forms, each designed to demonstrate a company’s capacity to fulfill its obligations. Claims-paying and debt ratings, for instance, assess an organization’s capacity to pay out on insurance claims or contracts as well as its capacity for repaying financial debts.

Claims-paying ratings provide insight into an insurance company’s capacity for satisfying claims, and can also be use by lenders when setting interest rates for commercial paper, loans or bonds. Debt ratings assess a company’s debt payment capacity and enable lenders to set terms on senior debt, surplus notes or commercial paper.

AM Best’s financial strength ratings form the basis of their comprehensive analysis, which takes into account both qualitative and quantitative elements. They also examine an insurance company’s underwriting cycle, competitive environment, reinsurance soundness and management experience to determine its overall strength.

Each year, AM Best conducts a review of an insurance company’s financial statements and conducts calls with the insurer to assess their performance. These calls are essential as they enable the analyst to confirm that the company remains on track towards reaching its objectives and maintaining its current ratings.

Innovation Assessments

On March 1, 2020 AM Best announce an evolution to their company rating methodology that adds an assessment of insurers’ innovation efforts. This signal that innovation has become mainstream for the insurance industry marks an important milestone.

AM Best’s innovation assessments assess how well an insurance company equipped to adapt to technological change. They take into account leadership, culture, resources and internal processes in order to rank carriers based on their overall innovation performance.

Companies with the highest innovation scores will demonstrate their success through measurable outcomes, as they treat innovation as part of an ongoing and dynamic process. Furthermore, these businesses successfully integrate new-stream innovations into their core operations, giving them a long-term competitive edge that cannot replicated.

According to AM Best, organizations with the highest innovation assessments will experience stronger net premium written growth rates and lower loss and expense ratios over time. Furthermore, they could experience less volatile underwriting results, potentially improving their financial strength and credit ratings.

However, the majority of MPL insurers have not fared as well on AM Best’s innovation assessment criteria. This is partly because MPL insurers typically face fewer market pressures to innovate; they often don’t need to make system upgrades which AM Best considers a more pressing innovation need.

Furthermore, MPL companies may lack the capital to finance these initiatives – particularly smaller regional or local insurers.

AM Best will consider an insurer’s specific circumstances, including competitors and lines of business when assessing its innovation capabilities. This includes whether the insurer is a leader among peers in its line of business or not.

AM Best is still working on developing the criteria for this innovation assessment and is seeking feedback from insurers and other interested parties. Once complete, AM Best will incorporate all of this input into a revised draft of their Credit Rating Methodology and Business Profile building block.

Social Media

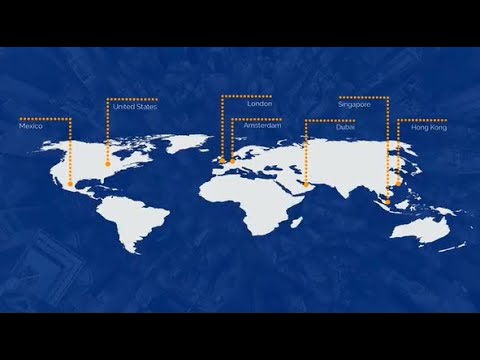

The company may headquarter in Oldwick, New Jersey but it has a presence across more than 100 countries. Established in 1899 by Alfred M. Best, AM Best has earned itself the trust of customers by providing them with numerous perks and discounts – one of which being an unbeatable staff discount! There are even plenty of chances to score free rides from experienced AM Best representatives who will surely leave you smiling from ear-to-ear with satisfaction on your face. With these stellar services provided by AM Best, customers are sure to leave satisfied and smiling from ear-to-sleeve!

Recommended readings: